|

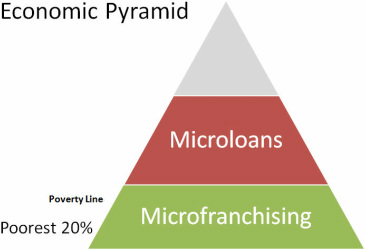

Aid can sometimes harm Microcredit has been a popular way of addressing large-scale global poverty in recent decades. And for a long time, high microloan repayment rates were seen as evidence that microcredit programmes were working well. However, perceptions are changing. Research done between 2003-2012 shows that microcredit hasn't led to significant improvements in poverty reduction. It can even make the poor worse off - for example, research from 2013 in Cambodia showed that 22% of microcredit borrowers studied were either insolvent or over-indebted. In fact, savings schemes are now considered a better strategy than helping people borrow their way out of poverty. And those high repayment rates mentioned above are often only achieved by people selling their only assets, or borrowing from other money lenders and family to repay the loans. This means the poor are caught up in a cycle of debt. Changes in income should be the key indicator when looking at programme success not repayment rates. Reasons why microcredit hasn't lifted most people out of poverty:

|

|

Our story |

Support us |

Contact us |

LegalCharities Act 2005 registration #CC48429

© Catalyst Microfranchising 2013 |